What Are Centralized Stablecoins?

Centralized stablecoins are digital assets controlled by a single entity that manages their issuance and redemption. These tokens are backed by real-world assets, such as fiat currency or treasury bonds, which can be liquidated when necessary. However, users must trust the issuer since there is no 100% on-chain way to verify the actual reserves.

Watch this video to deploy and interact with a Centralized Stablecoin.

Why Do Dollar-Pegged Stablecoins Maintain Their Peg?

The vast majority of stablecoins are pegged to the U.S. dollar. This allows users to rely on a familiar and widely accepted unit of value. While there are stablecoins pegged to other assets such as the euro, bitcoin, or stocks, still the dollar-pegged stablecoins dominate the market.

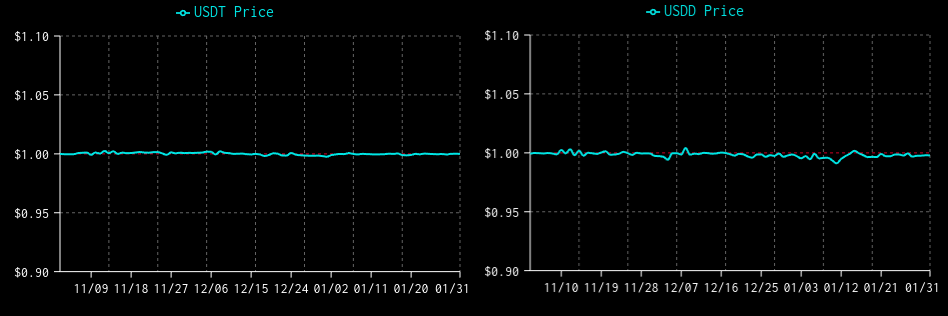

Centralized dollar-pegged stablecoins are able to maintain a tight peg to their underlying asset. This is because issuers can directly redeem stablecoins for fiat at a 1:1 ratio, ensuring price stability.

Centralized stablecoins like USDT maintain a strong peg to the USD compared to decentralized and algorithmic-based alternatives. This is known as market efficiency. Source: stablecoins.wtf

Additionally, centralized stablecoin issuers must comply with strict regulations. This often results in features that contradict core decentralization principles, such as blacklisting addresses and pausing transactions.

Developing a Centralized Stablecoin Smart Contract

In order to ensure the circulating supply accurately reflects off-chain reserves, centralized stablecoins have to implement functions for token creation and destruction:

Issuance (mint): The issuer generates new tokens when reserves increase. Redemption (burn): The issuer destroys tokens when reserves decrease.

Issuers also introduce regulatory features, such as:

Blacklisting (blacklist): Prevents sanctioned addresses from transacting. Pausing (pause): Temporarily halts all transactions.

Here’s an example implementation using Solidity:

// SPDX-License-Identifier: MIT

// Compatible with OpenZeppelin Contracts ^5.0.0

pragma solidity ^0.8.22;

// DO NOT USE THIS IN PRODUCTION! This smart contract has not been audited and is meant to educational purposes only

// OpenZeppelin libraries provide a prebuilt ERC-20 token implementation, allowing us to build on a secure and well-tested foundation.

import {ERC20} from "@openzeppelin/contracts/token/ERC20/ERC20.sol";

import {ERC20Burnable} from "@openzeppelin/contracts/token/ERC20/extensions/ERC20Burnable.sol";

import {ERC20Pausable} from "@openzeppelin/contracts/token/ERC20/extensions/ERC20Pausable.sol";

import {Ownable} from "@openzeppelin/contracts/access/Ownable.sol";

// ERC20 compatible smart contract with centralized features such as mint, burn, pause and blacklist

contract FiatBackedStablecoin is ERC20, ERC20Burnable, ERC20Pausable, Ownable {

constructor()

ERC20("Centralized Stablecoin", "CS")

Ownable(msg.sender)

{}

// All accounts marked ad blacklasted cannot transact

mapping (address account => bool isBlacklisted) blacklist;

// When the contract is paused no one can transact

function pause() public onlyOwner {

_pause();

}

function unpause() public onlyOwner {

_unpause();

}

// Adds an account to the blacklist, preventing it from transacting

function addToBlackList(address account) public onlyOwner {

blacklist[account] = true;

}

// The contract owner can control the supply of tokens by minting and burning

function mint(address to, uint256 amount) public onlyOwner {

_mint(to, amount);

}

function burn(uint256 amount) public override onlyOwner {

_burn(owner(), amount);

}

// _update is an internal function that is called on every transaction, this is the perfect place to check if an address is blacklisted

function _update(address from, address to, uint256 value)

internal

override(ERC20, ERC20Pausable)

{

// If an account is blacklisted it is prevented from transacting

require(!blacklist[from], "Sender is blacklisted");

super._update(from, to, value);

}

}Exploring Stablecoins Live on Ethereum

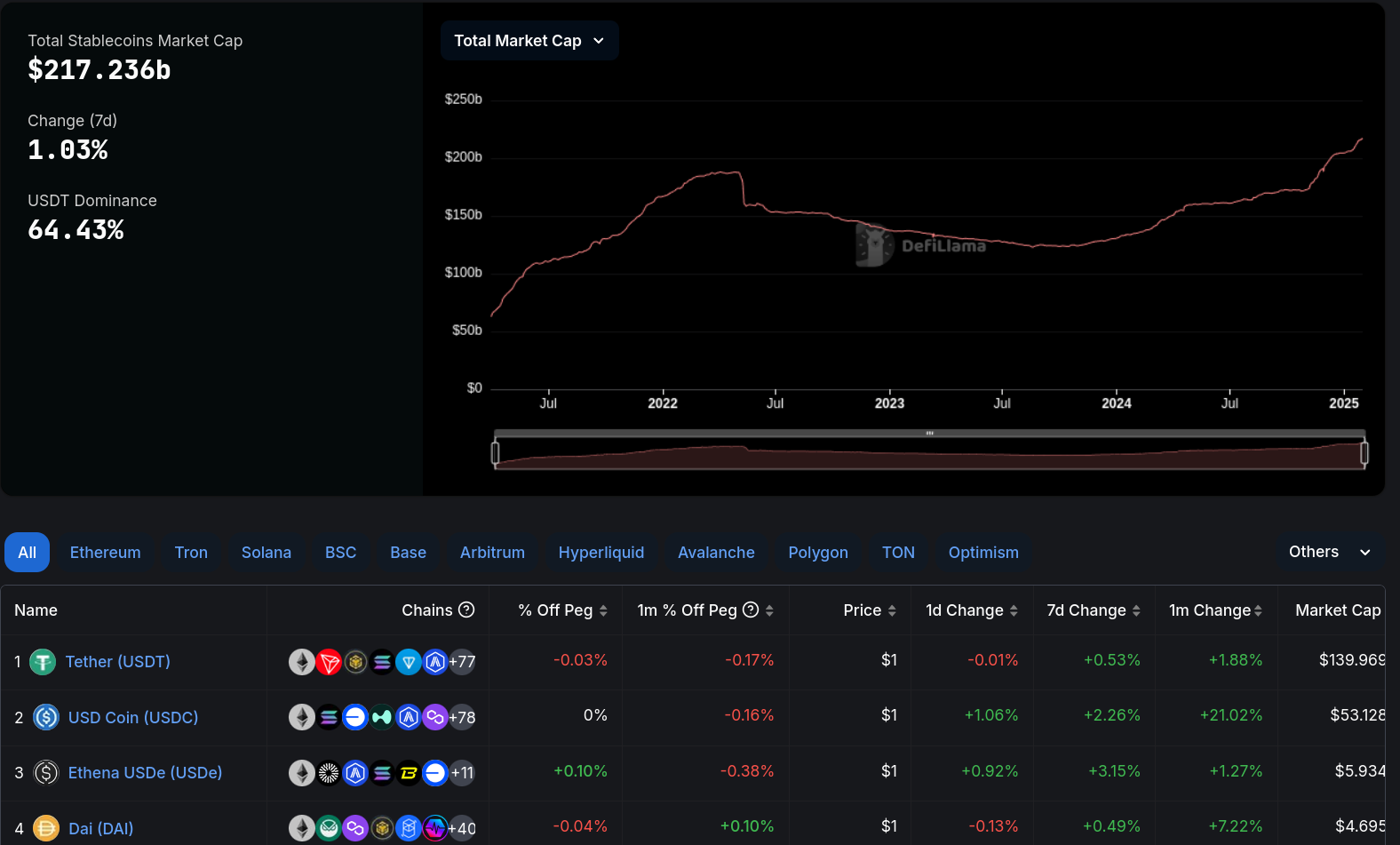

The two largest stablecoins by market capitalization are USDT and USDC. Let’s explore their features.

USDT and USDC dominate the stablecoin market. Source: DeFiLlama

USDT

USDT is issued by Tether and has a market capitalization exceeding $130 billion. It follows a standard centralized stablecoin model with minting and burning features:

- Issue (minting)

- Redeem (burning)

- Pause transactions

- Blacklist addresses

- Burn blacklisted funds

- Transaction fees (currently disabled)

More details:

USDC (Circle)

USDC is issued by Circle and is widely used in DeFi. Like USDT, it implements the most common structure in stablecoins: minting, burning, blacklisting, and pausing transactions.

More details:

Thanks for reading this article! Dollar-pegged stablecoins hold the top spot in the stablecoin space, by providing price stability and ease of use. However, an alternative exists that removes reliance on a central issuer, and that is overcollateralized debt stablecoins. Check out our next article to learn more!

More Content

Get familiar with the ERC20 format.

Learn how to embed crypto trading into your app using 0x Swap API

This guide will show a novel smart contract solution for onchain pricing without using Oracles

Dive into the world of Solidity in pursuit of leveling up! Venturing into delegatecall and staticcall functions!

Create a stablecoin with on-chain overcollateralized debt.